Not just individuals benefit from social media's power — businesses of all sizes recognize the potential for growth and profitability by investing in social media. Let's take a few minutes to explore how to invest in social media. We will discuss strategies such as influencer marketing, social media advertising, analytics, management tools and education and how they can help investors make more returns.

Social media has become ubiquitous daily, and it's hard to imagine a world without it. With the rise of social media platforms, people worldwide can connect and engage with each other in real time. Social media has transformed how we communicate, consume information and do business.

Numerous social media brands are available today, each platform having unique features and characteristics. The most popular social media brands include Facebook, Instagram, Twitter, LinkedIn, TikTok, YouTube and Snapchat.

Facebook is the largest social media platform in the world, with over 2.96 billion active users as of 2022. It was launched in 2004 and has since become a multi-billion dollar company. Facebook is a platform for sharing and consuming content, connecting with friends and family, and joining groups and communities of like-minded individuals.

Instagram, owned by Meta (Facebook's parent company), is a visual platform where users share photos and videos with their followers. Instagram has over one billion monthly active users, with an estimated 500 million using the platform daily. The platform has become a powerful tool for businesses to showcase their products and services and engage with customers.

Twitter is a social media platform that allows users to share short, 280-character messages called tweets. With over 330 million monthly active users, Twitter is an excellent platform for breaking news, real-time conversations and connecting with thought leaders and influencers.

LinkedIn is a social media platform for professionals and businesses to connect and network. The platform has over 774 million members and is ideal for recruiters, job seekers, freelancers and business owners.

TikTok is a relatively new social media platform that has overtaken the world. With over one billion active users, TikTok is a platform for short-form video content that appeals to a younger audience. It's an excellent platform for businesses looking to reach Gen Z and millennials.

YouTube is the world's largest video-sharing platform, with over two billion monthly active users. The platform has become a powerful tool for businesses to promote their products and services and reach a wider audience.

Snapchat is a social media platform allowing users to share short-lived content with friends and followers. The platform has over 500 million monthly active users and is excellent for businesses looking to engage with a younger audience.

Investing in social media can provide businesses with numerous benefits, including increased brand awareness, higher engagement rates, improved customer relationships and increased sales. Social media platforms allow companies to reach a vast audience through their marketing efforts, including posting content, advertising campaigns and engaging with users. With billions of users worldwide, social media platforms have become essential for businesses that want to promote their products or services.

Social media platforms allow businesses to engage with their customers and build relationships. Companies can establish trust and credibility by creating and sharing valuable content that resonates with their target audience, leading to higher engagement rates. The more engaged customers are with a brand, the more likely they are to become loyal and promote the brand to their friends and family.

Moreover, social media provides businesses with a platform to communicate with their customers directly, providing customer service and support. This direct communication lets companies quickly address customer concerns and issues, improving customer satisfaction and retention rates.

Social media can also be a powerful tool for driving sales. By running targeted advertising campaigns and promoting products and services, businesses can attract potential customers and convert them into paying customers. Social media platforms offer advanced targeting options that allow companies to reach specific audiences based on demographics, interests and behaviors.

Investing in social media startups can be an excellent way for investors to get in on the ground floor of the next big thing in the tech industry. Startups are newly established companies working on innovative ideas or developing new products or services. Investors are attracted to startups because they have the potential to snowball and generate high returns on investment.

There is always room for innovation and new ideas in this field. Startups that can create new ways for people to connect and engage with each other have the potential to capture a significant share of the social media market.

Another reason for investing in social media startups is the potential for high growth. Startups have the advantage of starting from scratch, allowing them to be agile and quickly pivot in response to changing market conditions. If a social media startup can create a product or service that people love, it can quickly grow its user base and revenue.

Investing in social media startups also allows investors to participate in something innovative and exciting. Social media startups often have young, dynamic teams passionate about their work and committed to making a difference. Being a part of such a team can be rewarding for investors who want to be involved in shaping the future of social media.

Finally, investing in social media startup funding and other forms of social media funding can be a way for investors to diversify their portfolios. Social media startups can allow social media investors to invest in a high-growth tech industry sector that a few prominent players do not yet dominate. This can be a way for investors to reduce their overall portfolio risk and increase their potential returns.

Social media has become an integral part of our daily lives, with millions worldwide using social media platforms to connect, share, and engage with others. As a result, social media has become a massive industry, with billions of dollars in revenue generated each year. While investing in social media giants like Facebook and Twitter may seem an obvious choice, there are many other ways to invest in the industry beyond buying stocks in established companies. Let's explore our options together.

Investing in new and emerging social media companies can provide the potential for high returns. This approach involves investing in private equity or venture capital funds focusing on early-stage social media startups.

Social media platforms are increasingly integrating e-commerce functionality, allowing users to purchase products directly from the platform. Investing in e-commerce companies can provide exposure to this trend.

Investing in social media influencers can provide exposure to the growth of influencer marketing. These individuals have large followings on social media and can help businesses promote their products and services. Investing in social media influencers helps to build the growth of social media platforms by exposing different platforms to influencers’ followers.

4. Data Analytics Companies

Social media generates vast amounts of data, which is used by businesses to inform their marketing strategies. Investing in companies that provide data analytics services for social media can give exposure to the industry.

Companies with patents related to social media can provide an investment opportunity for those interested in the industry. These patents can include technologies related to social media platforms, social media advertising, and social media data analysis.

Companies that provide the infrastructure for social media platforms, such as data centers, can provide an investment opportunity for those interested in the industry. Social media hosting platforms and cloud computing are growing in popularity exceptionally quickly, and this would be good exposure to the fast-moving parts of the social media industry.

7. Monitoring and Security Companies

Social media platforms are vulnerable to cyber threats, and companies that provide monitoring and security services can provide an investment opportunity for those interested in the industry.

As social media becomes increasingly important for businesses, there is a growing demand for education and training in social media marketing. Investing in companies that provide these services can provide an investment opportunity for those interested in the industry.

Investing in marketing agencies specializing in social media can provide exposure to the industry's growth. These companies help businesses develop and execute social media strategies, providing a way to invest in the industry without directly investing in social media companies.

10. Social Gaming

Investing in the social gaming market is an emerging trend in the social media industry. Social gaming refers to games played on social media platforms like Facebook and Instagram. It also includes games developed specifically for social play across multiple platforms.

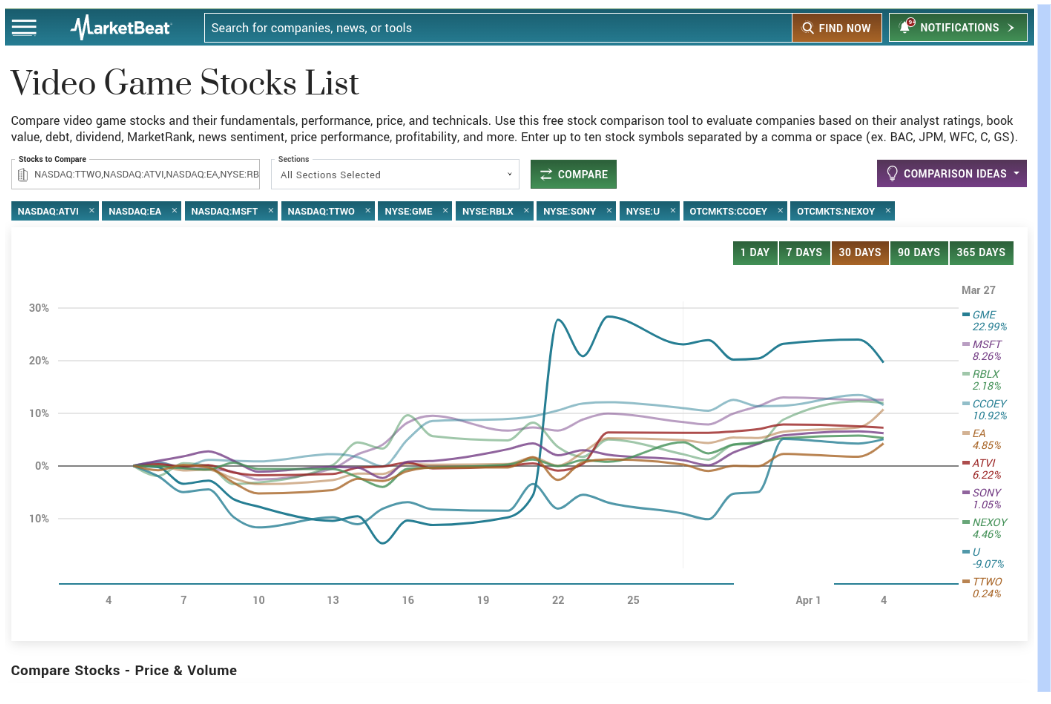

This market has seen significant growth in recent years, with the rise of mobile gaming and the increasing popularity of social media platforms. Investors have the opportunity to invest in social gaming companies, which can provide exposure to the growing market. There is a curated list of video gaming stocks on MarketBeat that you can review to get started in your research.

Social media can allow investors to participate in the growth of one of the world's most dynamic and rapidly evolving industries. However, investing in social media requires careful consideration and research, as investors can take many different approaches and strategies. Let’s take a moment to outline some of the critical steps that investors should take when considering investing in social media. These steps will help investors identify potential investment opportunities, assess the risks and benefits of investing in social media, and develop a clear investment strategy that aligns with their investment goals and risk tolerance.

Step 1: Research the industry.

Researching the social media industry is a crucial first step for investors considering investing in social media. This involves gathering information about the industry's current state and future outlook.

Investors can identify key trends and challenges likely to impact social media companies and the industry by researching the industry. For example, investors can gain insight into how user behavior changes, how social media platforms adapt to new technologies, and how regulatory changes could affect the industry. A great way to research items like this would be to open your favorite search engine and search for terms like "social media regulatory changes." Get the latest information on changes that could affect your investment by reviewing the news.

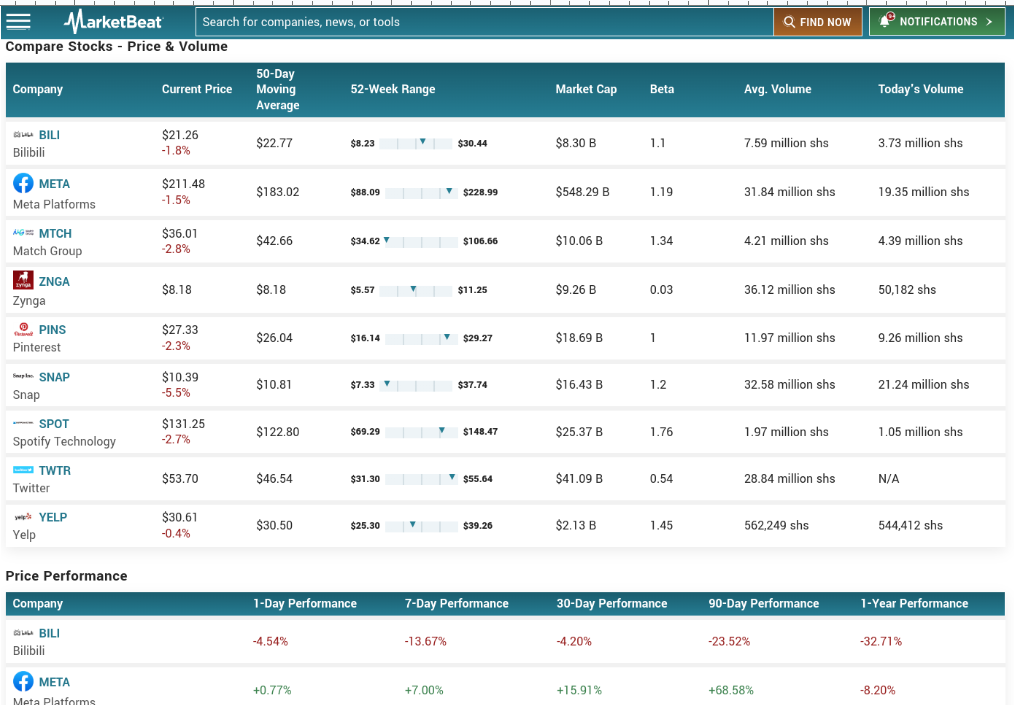

Additionally, by identifying the industry's major players, you can better understand how the industry is currently structured and who the dominant players are. This information can help investors identify investment opportunities in established social media companies and emerging startups disrupting the industry. Familiarize yourself with the industry's top players by reviewing the social media stocks list on MarketBeat.

Finally, researching the industry can help investors identify emerging technologies and companies that can disrupt the industry. This can help investors stay ahead of the curve and make more informed investment decisions.

Step 2: Determine investment goals and risk tolerance.

When investing in social media, as with any investment, it's crucial to determine your investment goals and risk tolerance. This involves evaluating your financial objectives and determining the level of risk you're willing to take.

Investment goals can vary widely from one investor to another. Some may seek to generate income through dividends or interest, while others may seek capital appreciation by investing in companies with solid growth potential. Still, others may want to balance income and growth by investing in a diversified portfolio of social media stocks, bonds and other assets.

Risk tolerance is also essential to consider when investing in social media. Social media is a rapidly evolving industry, making it more volatile than other investments. Investors with a low tolerance for risk may want to consider more conservative investments. In contrast, those with a higher tolerance may be willing to take on more risk in exchange for higher returns.

By determining your investment goals and risk tolerance, you can make more informed decisions about the types of social media investments appropriate for your portfolio. This may involve researching specific social media companies, funds or other investment vehicles and considering your overall asset allocation and diversification strategy. Ultimately, the goal is to build a portfolio that aligns with your financial objectives while managing risk appropriately. A great place to get started analyzing your risk tolerance is MarketBeat's comprehensive guide to determining your level of risk tolerance.

Step 3: Identify potential investment opportunities.

Identifying potential investment opportunities is a crucial step in investing in social media. There are various ways to invest in social media, including investing in established social media companies, new social media startups, social media-focused ETFs and social media-related intellectual property. Investing in established social media companies may offer more stability and less risk, while investing in new social media startups may provide more significant growth potential and risk.

Investing in social media-focused ETFs may offer diversification and exposure to the broader social media industry. Lastly, investing in social media-related intellectual property may offer potential long-term growth opportunities. Before deciding, investors must evaluate each possible investment opportunity based on their investment goals, risk tolerance and other factors.

Step 4: Evaluate investment opportunities.

After researching the social media industry and identifying potential investment opportunities that align with your investment goals and risk tolerance, the next step is to evaluate these opportunities based on their potential for growth, profitability, and risks.

One important factor to consider is growth potential. This involves analyzing the market size and growth potential of the industry or individual companies and the company's competitive position within the market. Look for companies with a strong track record of growth or a solid plan for future growth.

Profitability is another critical factor to consider. This involves evaluating a company's financial performance, including its revenue, earnings, and cash flow. Look for companies with solid financials and a history of profitability, which indicates a higher likelihood of generating a return on your investment.

By evaluating investment opportunities based on their potential for growth, profitability and risks, you can make more informed decisions about where to invest your money. This process may involve conducting thorough research, analyzing financial data and consulting with investment professionals. Ultimately, the goal is to identify high-potential investment opportunities that align with your investment goals and risk tolerance while managing risk appropriately.

Step 5: Develop an investment strategy.

The first step in developing your investment strategy is to identify the types of investments that you plan to make. This may include investing in established social media companies, emerging companies with high growth potential or technologies that support the social media industry. Your investment strategy should also consider the level of diversification you want to achieve across your portfolio, which can help manage risk and increase the potential for returns.

Next, you will need to determine how much money you are willing to invest in social media. This depends on your investment goals, risk tolerance and available capital. It's essential to consider your financial situation and ensure you are investing only what you can afford to lose.

Finally, you should develop an expected return on your investment. This can help you evaluate the performance of your investments over time and ensure that you are meeting your financial goals. Your expected return should be based on a realistic assessment of the potential returns for each asset, taking into account factors like growth potential, profitability and risk.

By developing a clear investment strategy, you can ensure that you are investing in social media in a way that aligns with your goals and risk tolerance while also managing risk appropriately. This may involve consulting with investment professionals, conducting market research and regularly reviewing and adjusting your portfolio.

Step 6: Choose your vehicle.

Investors can use several types of investment vehicles to invest in social media. Investing in stocks and ETFs can be a popular way to invest in social media. Many established social media companies are publicly traded, meaning that investors can buy shares of their stock. Investing in individual social media stocks can be a high-risk, high-reward proposition. These companies can be highly volatile and subject to changes in user behavior, industry trends and regulatory environments.

However, by investing in a diversified portfolio of social media stocks through an ETF, investors can reduce their risk exposure while still participating in the growth potential of the social media industry. Social media ETFs, like the Global X Social Media ETF (NASDAQ: SOCL) and the Communication Services Select Sector SPDR Fund (NYSEARCA: XLC), provide investors with a diversified portfolio of social media stocks and exposure to other companies within the broader communication services industry. These ETFs can offer investors a way to gain exposure to the social media industry without selecting individual stocks or conducting extensive research. However, it's important to note that investing in ETFs still involves risks, including market and sector-specific risks and potential fees and expenses associated with the ETF.

Step 7: Monitor your investments.

Monitoring your investments is crucial in social media investing or any other asset class. Keeping a close eye on your investments and tracking their performance regularly is vital to ensure they meet your expectations. By monitoring your investments, you can identify potential risks or opportunities and make necessary adjustments to your investment strategy to maximize returns and minimize risks.

One key aspect of monitoring your investments is to track their performance metrics, such as revenue growth, user engagement, and market share. This will help you understand how your investments perform relative to their peers and the broader market. You should also monitor any news or developments related to your investments, such as new product launches, strategic partnerships, or regulatory changes that could impact their performance.

In addition, it's essential to review your investment strategy and make adjustments as necessary periodically. This could include rebalancing your portfolio, increasing or decreasing your investment allocations, or exiting certain positions altogether. Regularly monitoring and adjusting your investment strategy ensures that your portfolio remains aligned with your investment goals and risk tolerance. A great way to get started monitoring your investments is to utilize tools like MarketBeat’s real-time stock market news feed.

Investing in social media can be a lucrative opportunity for investors, but it's important to consider both the advantages and disadvantages before making investment decisions. On the one hand, social media is a rapidly growing industry with tremendous potential for growth and innovation. On the other hand, it is also a highly volatile and unpredictable market that can be affected by various factors, such as changing user trends, privacy concerns, and government regulations. We will explore the pros and cons of investing in social media to help you decide whether or not to invest in this industry.

Pros

Investing in the social media industry has become increasingly popular due to its rapid growth and potential for high returns. The sector has revolutionized how people connect and communicate, becoming an integral part of modern society. With more and more people using social media platforms daily, investors have numerous opportunities to capitalize on this trend. We will discuss the pros of investing in the social media industry.

- High growth potential: The social media market is one of the fastest-growing industries, with a large user base that continues to expand globally. This presents investors with an opportunity to invest in companies that have the potential to grow rapidly and provide high returns on investment.

- Low barrier to entry: The social media market has a relatively low barrier to entry, with new startups emerging regularly. This means that investors can invest in these startups with relatively small amounts of capital and benefit from their growth. Investors can search for these startups by reviewing the best low-priced stocks on MarketBeat.

- Diversification: The social media market offers investors a diversified range of investment opportunities, from established companies like Facebook and Twitter to emerging startups. This diversification helps spread out investment risks and can help investors build a well-rounded investment portfolio.

- Flexibility: Social media investors appreciate flexibility in terms of investment options. Depending on their investment goals and risk tolerance, they can invest in individual companies, social media-focused ETFs, or social media-related intellectual property.

- Access to valuable data: Social media companies generate vast amounts of data that can be valuable to investors to understand consumer behavior and market trends. This data can help investors make more informed investment decisions and stay ahead of the competition. Utilizing the data collected in researching the social media industry could be helpful in other investment strategies. These high media sentiment stocks and stocks with trending media mentions could help investors find new investment vehicles to diversify their portfolios.

- Social impact: Investing in social media companies can allow investors to make a positive social impact. Many social media companies focus on connecting people and building communities, and investing in these companies can contribute to advancing social causes.

Cons

While investing in the social media industry can have benefits, there are also potential drawbacks. As with any investment, weighing the potential risks and rewards before committing your money is essential. Let's take a moment to look at some of the cons of investing in the social media industry to help you make an informed investment decision.

- Regulatory risks: The social media industry is subject to various laws and regulations, which can change quickly and significantly impact the industry. Changes in laws and regulations could lead to increased costs, reduced profitability and potential legal liabilities for social media companies.

- Cybersecurity risks: Social media companies are at risk of cybersecurity threats, including hacking, data breaches and malware attacks. These threats can result in significant financial losses, damage to reputation and loss of user trust.

- Monetization challenges: While social media companies may have large user bases, monetizing these users can be challenging. Advertisers may hesitate to advertise on specific social media platforms, and competition for ad revenue can be intense.

- Rapidly changing technology: The social media industry constantly evolves, with new technologies and platforms emerging regularly. Investing in a particular social media company may become obsolete as technology changes and users migrate to new platforms.

- Dependence on user engagement: The success of social media companies is mainly dependent on user engagement. The company's financial performance could suffer if users lose interest in a particular social media platform.

- Privacy concerns: Social media companies collect vast amounts of user data, and there are concerns about how this data is being used and shared. Privacy concerns can lead to legal challenges, loss of user trust, and reduced user engagement.

- Reputation risks: Social media companies can quickly lose public trust and face reputational damage due to data breaches, censorship controversies, and the spreading of misinformation and disinformation on their platforms in an attempt to scam users.

The future of social media is an exciting and ever-evolving topic with much potential for growth and innovation. As technology advances and consumer behavior shifts, social media platforms must adapt to stay relevant and competitive. One major trend in the future of social media is the increasing focus on privacy and data protection, as users become more aware of how their personal information is being used and shared. Another trend is the rise of video content and live streaming, as platforms like TikTok and Instagram continue to gain popularity.

Additionally, integrating social media with e-commerce and digital payments is likely to continue, with platforms like Facebook and Instagram already offering shopping and payment options within their apps. As artificial intelligence and augmented reality technology improve, social media platforms may incorporate these features to enhance user experience and engagement. Overall, the future of social media is bright and full of potential, but investors need to stay informed and adaptable as the industry continues to evolve.

Seizing Opportunities in a Changing Landscape

Social media has undoubtedly changed the way we interact with each other and consume information. With billions of active users on various platforms, social media has also opened up many investment opportunities for those interested in the industry. However, as with any investment, there are also risks to consider. Investors should be aware of the potential downsides, such as regulatory concerns and the ever-changing nature of the industry.

Despite the risks, the future of social media appears to be bright, with new technologies and platforms emerging regularly. As investors, it's essential to keep up with industry trends and to stay informed about the latest developments in the field. This will help you identify potential investment opportunities and manage risks effectively.

Investing in social media can be an exciting and profitable venture for those who approach it with a clear strategy and an understanding of the industry's risks and opportunities. With the proper research, planning and monitoring, investors can seize opportunities in a changing social media landscape and potentially reap significant rewards.

FAQs

Do you have questions about investing in social media? Investing in social media can seem daunting at first, especially for those new to the market or unfamiliar with the industry. That's why we've compiled a list of frequently asked questions to help provide clarity and guidance for those looking to invest in this rapidly growing sector. Let's dive into some of the most commonly asked questions and explore the world of social media investing together.

Yes, you can invest in social media by purchasing stocks, mutual funds or exchange-traded funds (ETFs) from companies operating in the social media industry. The best option will consider your entire portfolio as a whole.

There is no single "best" social media stock to buy, as the performance of individual stocks can vary depending on market conditions and company-specific factors. It's essential to conduct thorough research and consider financial health, growth potential and valuation before making investment decisions.

Yes, several ETFs focus on investing in social media companies, such as the Global X Social Media ETF (NASDAQ: SOCL). These ETFs provide exposure to a diversified portfolio of social media companies, allowing investors to invest in the broader social media industry rather than just individual stocks.