What is FAANG, anyway?

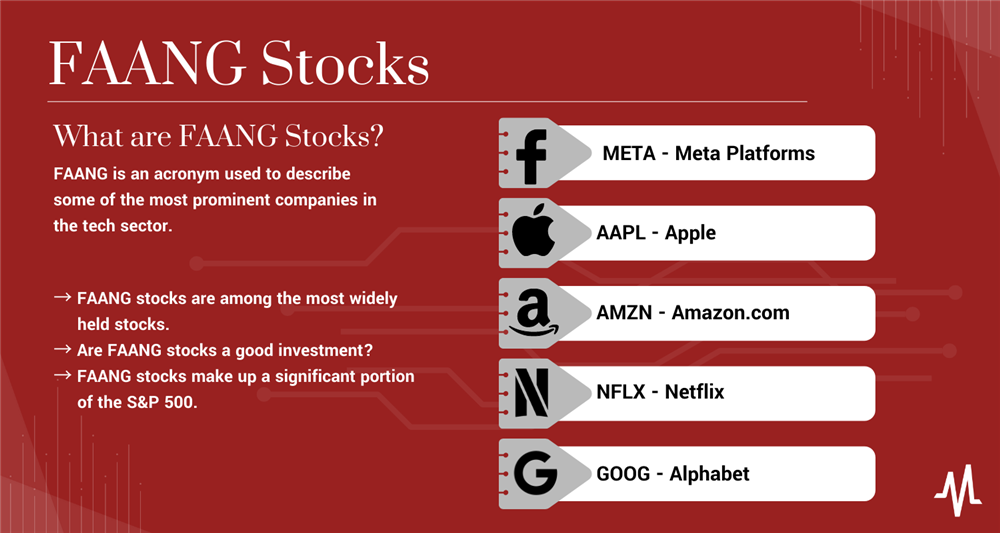

No, they aren't stocks for vampires. FAANG is an acronym representing five of the most successful companies over the last decade: Meta Platforms Inc. (NYSE: META), Apple Inc. (NASDAQ: AAPL), Amazon.com Inc. (NYSE: AMZN), Netflix Inc. (NASDAQ: NFLX) and Alphabet Inc. (NASDAQ: GOOG).

Facebook and Google may have officially changed their company names. Still, FAANG remains a popular acronym for tech stock investors looking to boost their portfolio with some of the biggest winners since the Great Financial Crisis. But what does the future hold for these former market champions?

What Does FAANG Stand for?

The FAANG stocks have changed over time. In some instances, FAANG didn't include Apple! Even when considering the five companies under the umbrella, FAANG is outdated. Old acronyms die hard and FAANG remains a popular way to group these five massive components of the U.S. stock market.

The five FAANG companies originated as::

- Facebook (now Meta Platforms)

- Amazon

- Apple

- Netflix

- Google (now Alphabet)

These five stocks were the pinnacle of the tech industry during the bull market that followed the 2008 financial crisis, starting with Facebook's IPO in 2012. FAANG was a coin termed on CNBC broadcasts, popularized by Jim Cramer on his "Mad Money" TV show back in 2013. At the time, all 5 FAANG stocks showed exceptional growth potential through their utilization of innovative technology.

Overview of FAANG Stocks

As mentioned above, the FAANG meaning originated on financial TV back in 2013 when all five firms were primed for outsized growth. Despite all five companies in the tech sector, all five have very different business models and goals.

Recent iterations of the acronym have expanded to include companies like Microsoft Inc. (NYSE: MSFT).

Why no Microsoft? At the time, financial pundits didn't believe Microsoft had the same prospect as the other five companies because the cloud wasn't a central theme of tech growth. In retrospect, Microsoft's exclusion from the tech sector totem pole seems like a mistake, as it's outperformed every FAANG stock but Apple since the start of 2018.

Mark Zuckerberg founded Facebook in 2004 as a college networking site and grew into the first social media power. Facebook went public in 2012 and the stock was a winner immediately, going from $20 a share to over $200 a share in just six years. Facebook dove headfirst into the metaverse to begin its second decade as a public company, rebranding itself as Meta Platforms and changing its stock ticker to META. The stock reached an all-time high of $377 in early September of 2021 but led the tumble of tech stocks toward the end of the year. By November 2022, the stock had dipped below $100.

Amazon

Amazon began as an online bookseller during the 1990s internet boom and grew into the largest online retailer the world had ever seen. Additionally, the stock has been one of the biggest success stories in the history of markets. Amazon reached a split-adjusted all-time high at $184 in September of 2021, marking a gain of over 260,000% since its 1997 IPO. Today, Amazon has its hands in far more industries than just retail, such as its Amazon Web Services platform and Prime Video streaming service.

Apple

One of the blue chips of the U.S. stock market, Apple is also the oldest member of the FAANG gang. Apple was founded in 1976 by Steve Jobs and Steve Wozniak and had immediate success, going public just four years later, on December 12, 1980. Today, almost everyone uses or knows someone who uses Apple products, such as the iPhone or iPod. Like most high-flying tech stocks, Apple reached its all-time high closing price at the end of 2021 and has since dropped, but not nearly as much as the rest of its FAANG brethren.

Netflix

Today, Netflix is one of the dominant streaming services, with hit shows like "Stranger Things" and "Squid Game." However, the company began in 1997 as a rival to movie rental stores like Blockbuster. Instead of streaming, Netflix would mail movies to its customers to watch at home, who would then return them via mail. Netflix began streaming in 2007 and today has customers in over 190 countries. The stock had its IPO in 2002 on NASDAQ and has been one of the more volatile FAANG stocks, especially since 2015. It reached its all-time high of $691 in November 2021.

More than 70% of internet searches happen on Google, the online search behemoth founded by Sergey Brin and Larry Page in 1998. Brin and Page revolutionized how online search produced results by ranking websites using a particular set of factors.

Google went public in 2004 and trades with two public share classes: GOOG (Class A shares) and GOOGL (Class C shares). The company rebranded as Alphabet Inc. in 2015, but most revenue still comes from Google advertising services.

How to Buy FAANG Stocks

Buying FAANG stocks is easy since they've been some of the top-rated tech stocks over the last decade. However, consider planning your trades and have goals for your investments.

Step 1: Open a brokerage account.

Check out the features and tools various brokerage firms offer and choose the one that best fits your needs.

Step 2: Fund your account.

How much capital will you devote toward your FAANG stock investments? Buying individual stocks is always risky, especially in the tech sector. Be sure to limit your exposure to any particular stock or group of stocks if you want to build a diverse portfolio.

Step 3: Determine which FAANG stocks to buy.

Which FAANG stocks are choices for your portfolio? You can buy all five in equal proportions, but you don't have to. Buy the stocks you feel most confident about or equally weight your holdings across all five. Another option would be a FAANG ETF, which provides exposure to all five companies through a single security.

Step 4: Plan your trades.

Are you trading for the short term or investing for the long term? Know how long you want to hold your positions and your profit goals and loss limits for each stock.

Step 5: Open your positions.

With your account funded and trades planned, it's time to buy stocks. Look them up on your broker's website or app and open the positions you laid out in your investment plan.

FAANG stocks gained notoriety during the mid-2010s because they were some of the most successful investments. Once Facebook debuted in 2012, the five FAANG stocks often outpaced the market, and many investors recalled the acronym bestowed on the group by Cramer.

The older stocks like Amazon and Apple have all suffered significant declines, but the FAANG group looked impervious to long drawdowns. However, 2022 was the worst year in a decade for this group. Facebook suffered the worst, but all five companies saw their stocks decline by 30%, even the group's stalwart Apple. The outlook for the FAANG group remains murky, considering current inflation levels and the reversal of cheap money policies.

Where Do FAANG Stocks Trade?

The FAANG stocks all trade on the NASDAQ Exchange, and locating shares is never a problem. Every major American broker will have access to FAANG stocks; trade execution will be quick and smooth.

Are FAANG Companies a Good Investment?

FAANG stocks have been a terrific investment if you began buying shares shortly after the origination of the acronym. But now this group is entering an unfamiliar economic environment, especially Meta Platforms, which has never traded publicly during rising interest rates. The tech sector is expecting layoffs and could hit if the U.S. enters a recession in 2023, so the outlook for the FAANG group is cloudier than in years past, just like the broader tech sector.

Can You Invest in a FAANG ETF?

Yes, you can invest in a FAANG ETF from Direxion, but there are a few important caveats to discuss. First, the securities offered by Direxion that track FAANG stocks are leveraged, meaning they outperform when FAANG stocks do well and underperform when they do poorly.

Leveraged ETFs also have complex structures and often shift away from their targeted index over time, resulting in tracking errors. Use caution when investing in these FAANG ETFs (or any ETF or security that uses leverage).

Future of FAANG Stocks

Four of the five companies in the FAANG group have all been public for 15+ years, but this type of market environment is unique for all of them. This group of stocks never traded during a period of high inflation and rising interest rates. Matching the gains produced through the pandemic period will be difficult and these stocks could underperform the market if inflation and high rates prove stickier than anticipated.

However, all five companies have substantial footprints in their industry and certainly aren't in mortal danger. The outlook may be uncertain due to economic conditions beyond the control of these firms, but they'll be a mainstay in millions of portfolios for a long time to come.

FAANG Stocks Led the Way but Market Tides Are Shifting

FAANG is an acronym coined by financial pundits to group Facebook, Apple, Amazon, Netflix and Google in 2013. At the time, these stocks were the darlings of the tech sector and their growth in the decade following Facebook's IPO was nothing short of remarkable. But nothing lasts forever in markets, and all five companies saw their impressive runs cut short as tech melted down toward the end of 2021.

We'll likely still use FAANG's products many years from now. One of the problems of concentrated sector investing (like investing in FAANG stocks) is when economic conditions change. Low borrowing costs and minimal inflation boosted tech giants, but those factors are changing quickly. The stocks themselves will be fine but will FAANG still be synonymous with impressive outperformance in the coming decade?