Dividend Challengers provide investors with a unique opportunity to enter the market at a lower initial investment price when compared to dividend aristocrats. However, there are a few important considerations investors will need to note before researching Dividend Challengers.

Read on to learn more about Dividend Challengers, access a Dividend Challengers list and place your first buy order.

What is a Dividend Challenger?

Before fully discussing what a Dividend Challenger is and why you should look for companies that pay a dividend, it's essential to understand what a dividend is and when you earn them. A dividend is a small portion of a company's profits distributed to shareholders, usually in the form of a cash deposit directly to the shareholders' brokerage accounts. Corporations may distribute dividends to investors to encourage them to hold their stock or as a return on the initial investment.

Companies with excess cash on hand may choose to pay dividends to distribute that cash to shareholders rather than keeping it on the balance sheet. In some cases, distributing dividends may also come with tax advantages for the company issuing the dividends.

Few companies are required to pay dividends. Many investors are surprised to learn that major blue-chip corporations like Amazon.com Inc. (NASDAQ: AMZN) do not pay dividends despite record-breaking profits. Blue-chip companies with steady cash flow and a solid investor base may not need to pay dividends to improve liquidity. Issuing dividends is a way to reward older investors and demonstrate financial strength.

Understanding Dividend Challengers

Increasing a dividend over time is one way to demonstrate that a company's dividend is sustainable. As profits increase, companies that have put dividends into place may want to increase them over time as a signal to investors that continued growth is sustainable. A history of growing dividends may also help investors identify value stocks poised to increase in value over time or that are currently undervalued.

Many investors look at dividend history before selecting which companies to add to a passive income portfolio, which helps them avoid dividend traps and companies that have increased dividends to unsustainable levels.

Dividend Challengers attempt to attract investors by showcasing financial strength. A company that consistently raises its dividends signals to the market that it is financially healthy and has a stable and predictable cash flow. This can increase the company's stock demand, driving up the share price. Companies that continue increasing dividends also see less volatile stock price movements, which can help stabilize cash flow. Dividend Challengers provide a tangible return on investment, which can also attract a new class of investors.

While you can screen dividends for investments using a stock screener, most screeners only display the most recent dividend yield. Dividend Challengers may represent the ideal balance of value and distributions for new investors learning more about growth stocks.

Examples of Dividend Challengers

There are hundreds of Dividend Challengers, and the list is growing and changing every year. Some examples of current Dividend Challengers include the following:

- Ally Financial: Ally Financial Inc. (NYSE: ALLY) is a financial services company based in the United States. The company provides a range of financial products and services, including online banking, auto financing, insurance, investment services and mortgage loans and is one of the country's largest online banks. Ally has increased its dividend by 20.84% over the last three years.

- Equinix: Equinix Inc. (NASDAQ: EQIX) is a global data center and interconnection company providing business storage and cloud services. The company's colocation services allow businesses to rent physical space within Equinix's data centers and deploy IT equipment. The company's interconnection services enable enterprises to connect to other companies and networks within the Equinix ecosystem. Equinix has increased its dividend by more than 8% in the last three years.

- MetLife: MetLife Inc. (NYSE: MET) is a global financial services company that provides a range of insurance, annuities, employee benefits, and asset management services. MetLife is one of the largest insurance companies in the world, with operations across North America, Europe and Asia. Over the past three years, MetLife has increased its dividend by 4.4%.

- Sirius XM: Sirius XM Holdings Inc. (NASDAQ: SIRI) is a satellite radio and audio entertainment company that offers commercial-free radio programs on a subscription basis. Sirius channels provide listeners access to music, comedy, sports commentary channels and other audio entertainment through satellite connections with cars, mobile devices and more. Over the past three years, Sirius XM increased its dividend by 22%.

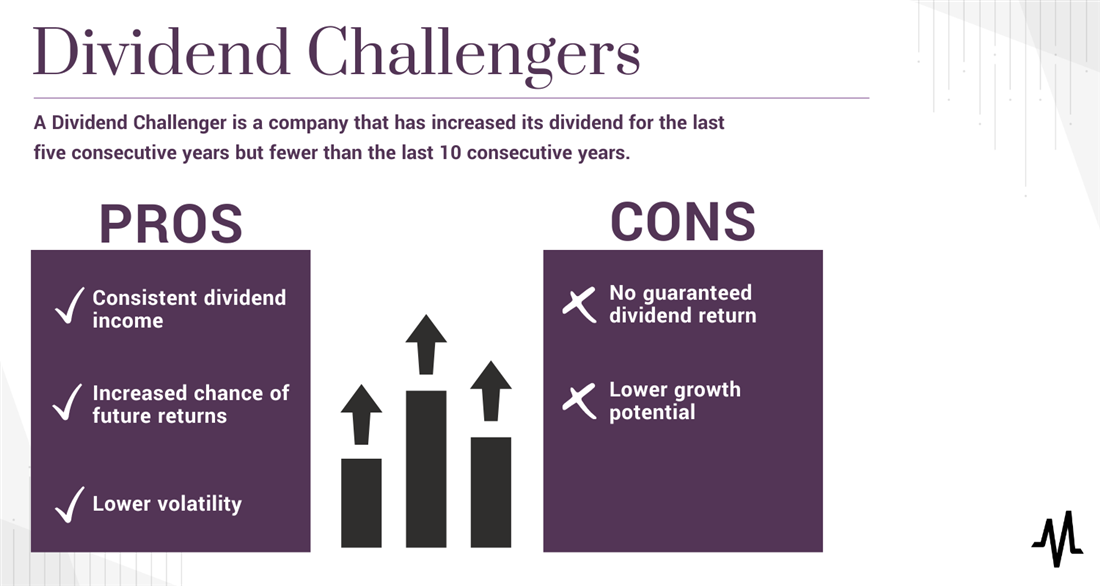

Pros and Cons of Investing in Dividend Challengers

While investing in Dividend Challengers is a universally good choice, there are a few drawbacks you'll want to consider before selecting which stocks to buy.

Pros

Look at the benefits of investing in Dividend Challengers:

- Consistent dividend income: Perhaps the most popular reason to invest in Dividend Challengers or explore our Dividend Kings list on MarketBeat is that companies that offer dividends can provide a passive income stream, offering an immediate return on investment for stock owners, which can help offset the initial investment cost.

- Increased chance of future returns: Companies that have increased their dividend multiple years in a row may do so as a way to demonstrate their financial strength. Investing in Dividend Challengers gives you a higher chance of seeing increased returns in the future, which you can calculate when you consider your buy-in price.

- Lower volatility: Dividend stocks, including Dividend Challengers, typically show less volatility than companies that do not have a history of distributions. This is because companies with a history of dividend increases are usually more established and financially stable, making them attractive choices for long-term investors.

Cons

What about the downsides?

- No guaranteed dividend return: Very few companies are required to pay out dividends to investors — and even the best dividend stocks might have to cut dividends in times of economic downturn. Just because a stock is currently a Dividend Challenger does not mean you are guaranteed to see higher dividend returns in the future.

- Lower growth potential: Dividend Challengers may not offer the same potential for growth as smaller, high-growth companies just getting started on the market. Smaller companies that cannot yet afford dividends may show more growth potential, giving you a bigger overall return. This can limit the upside potential for capital appreciation on stocks already paying a consistent dividend.

Dividend Achievers vs. Dividend Challengers

Dividend Achievers are similar to Dividend Challengers because they are companies that showcase solid financial histories and track records on the market. Dividend Achievers, like Challengers, also look to attract investors by increasing their dividends year after year. However, Dividend Achievers have increased their dividends for at least 10 consecutive years. This means that a Dividend Challenger can eventually be upgraded to an Achiever if it grows its dividend at least once annually.

Some examples of Dividend Achievers include:

You can view a complete Dividend Achievers list here to explore investment options.

Dividend Contenders vs. Dividend Challengers

Like Dividend Challengers, Dividend Contenders aim to attract investors by offering steadily increasing dividends. Contenders are stronger than Challengers and Achievers alike, having increased their dividends for the last 10 to 25 years. Contenders are in the later stages of developing a growth path and often have higher entry prices per share.

Some examples of current Dividend Contenders include:

Dividend Contenders and Challengers can be attractive investments for dividend-focused investors, but they may appeal to different investing strategies. Contenders are typically larger and more established companies that may offer more stable dividend growth. In comparison, Challengers are often smaller and more dynamic companies that may offer higher potential for capital appreciation and dividend growth.

Check out MarketBeat's Dividend Aristocrats list to learn about companies issuing consistent dividends.

Investing with Dividends

Many investors are attracted to the immediate returns of dividend investing. Investing in Dividend Challengers is a way to avoid dividend traps, but it's important to remember that no company can guarantee future increased returns. Be sure to review as much dividend history as possible before investing, so you're setting yourself up with investments that are more likely to provide consistent returns.

FAQs

Ready to learn more about Dividend Challengers and Achievers? Read on to learn the answers to some of the most common questions new investors have about dividend investors.

What is a Dividend Challenger?

A Dividend Challenger is a company that has increased its dividend for the last five consecutive years but fewer than the last 10 consecutive years. Dividend Challengers allow investors to add a passive income stream with a comparatively lower initial investment. David Fish created the concept of a Dividend Challenger, and the DRIP Investing Resource Center maintains a list of Dividend Challengers currently trading on the market.

How many Dividend Challengers are there?

Why are the Dividend Challengers important?

Dividend Challengers are important because they represent companies with a history of increasing their dividends year after year, allowing investors to add a potentially passive income stream to their portfolio. A history of increasing dividends may indicate that a company is on a healthy financial path and may be able to continue paying dividends in the future.